e-Invoicing Project – Phase 2

About the project

e-Invoicing exchanges electronic invoices between buyer and supplier.

e-Invoicing will automate invoice processing for Government agencies. Automating this process reduces manual data entry from paper or digital invoices.

Government will use the Pan European Public Procurement Online (PEPPOL) Network for e-Invoicing.

Key facts about the PEPPOL Network

- Uses open, international-standard specifications for document exchange

- Relies on access points that PEPPOL authorities authorise

- The Australian Tax Office (ATO) is the Australian PEPPOL Authority

- Australia has 44 approved PEPPOL Access Points

- The ATO uses world-leading security protocols to manage access points

- Parties must register with the ATO before using access points

- Each registered party has their own unique Participant ID

QSS is implementing e-invoicing in stages:

- Completed

- Connect the Rest of Government (RoG) SAP solution to PEPPOL Access Point

- Build and BETA test e-invoicing in the RoG SAP solution

- In progress

- Help connect all Government service providers to a PEPPOL Access Point

- Prove Minimum Viable Product (MVP) has been delivered

- Future

- Engage with Government and industry stakeholders to increase vendors using PEPPOL network

- Enable e-invoicing for all Government SAP solutions

- Redesign of accounts payable (AP) processes

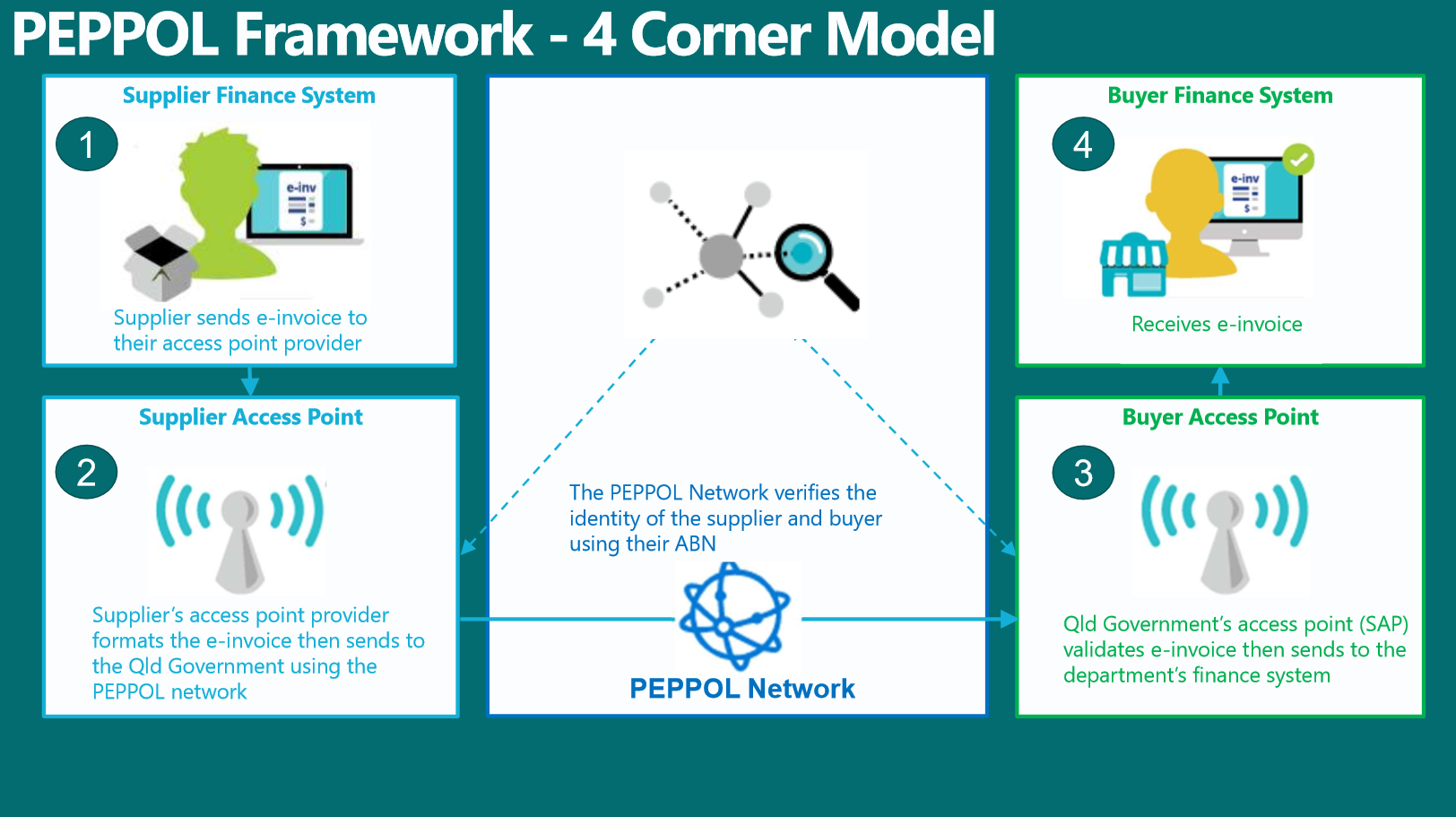

PEPPOL uses a ‘4 Corner Model’ for exchanging invoices:

Agencies will still need to check invoices match goods or services received. e-Invoicing does not automate paying of invoices.

All relevant staff will receive e-invoice training and access to learning materials.

Benefits

Cost Savings

e-Invoicing saves on costs by using agreed global standards and best practices and reducing manual processing.

Increased efficiency

Automating invoice processing improves data accuracy and saves time. e-Invoicing will help agencies pay invoices on time and manage cashflow.

Enhanced security and compliance

PEPPOL’s secure network protects data and reduces fraud risk. e-Invoicing helps auditing and regulatory reporting by keeping comprehensive digital records.

Key milestones

Phase 1, or the pilot phase of the project, commenced in November 2022 and closed in January 2024.

QSS commenced Phase 2 in February 2024 and is aiming to roll out e-Invoicing to QSS by the end of 2024. QSS aims to roll out e-invoicing to the rest of in-scope agencies in 2025.